CAPLA Real Estate Lecturer James Marian Provides Insight on 2021's Cities with the Most Leveraged Mortgage Debtors for WalletHub

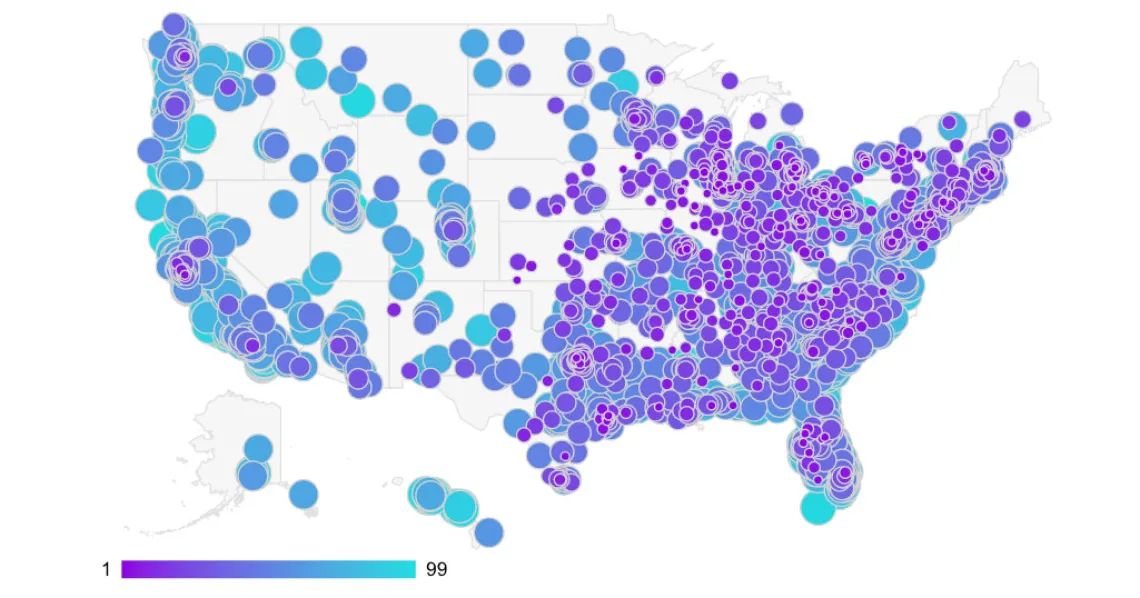

U.S. cities with most overleveraged mortgage debtors. Image courtesy WalletHub.

In WalletHub's evaluation of 2021's cities with the most overleveraged mortgage debtors, the financial information resource turned to real estate development experts for additional insight. James Marian, adjunct lecturer in the University of Arizona Master of Real Estate Development program, is one of those experts.

James Marian, Lecturer in Real Estate Development

In its analysis, WalletHub compared median mortgage balances against the median income and home value for more than 2,500 U.S. cities to determine those cities with the highest mortgage debts. Cities ranked as most overleveraged include Park City, Utah, Trenton, New Jersey, and Santa Ana, California. Least overleveraged cities include Bronxville, New York, Decatur, Georgia, and Naples, Florida. Tucson and Flagstaff, Arizona, rank in the 82nd percentile while Phoenix ranks in the 72nd percentile. In WalletHub's rankings, those cities in the 99th percentile are most overleveraged and therefore most at risk.

“The pandemic has been a very positive thing for the housing market. When values continue to increase, buyers get overconfident and are willing to take on more risk, which can mean more debt,” says Marian in the article. “Unfortunately, it will take a market correction to rid the marketplace of its overconfidence."

For those who are currently overleveraged in their home and have trouble affording their mortgage payments, Marian advises to “meet with a trusted realtor and your lender. Find out how much you are overleveraged, get an update on current market value trends and find out what your lender might be willing to do. The last thing the lender wants is to do is foreclose on a home.”

View all of Marian’s responses on WalletHub.

Marian teaches real estate finance, manages capstone projects and student internships and helps direct CAPLA’s Master of Real Estate Development program. A 1979 graduate of the University of Arizona, he is also the founding partner and designated broker of Tucson-based Chapman Lindsey Commercial Real Estate.